Table of Contents

As an Amazon Associate, I earn from qualifying purchases.

Who Buys Peloton Bikes?

Who Buys Peloton Bikes? Peloton bike buyers are primarily women (67%), aged 35-44 (33% largest group), with household incomes over $100,000, seeking convenient, community-driven home workouts in urban or suburban settings.

Key Demographics

Peloton appeals to affluent, time-constrained adults.

- Gender: 67% women, 33% men among U.S. hardware owners.

- Age: Largest group 35-44 (33%); followed by 45-54 (25%); 25-34 (22%); minimal under 25 or over 65 (2-4%).

- Income: Over 60% households >$100,000; 22% >$250,000; significant portion $100k-$250k.

- Location: Primarily U.S. (88% revenue); urban/suburban professionals.

Nearly 70% users aged 35+; fastest-growing 25-44.

For insights, see PeloBuddy demographics analysis.

Buyer Profile and Motivations

Typical buyers: Busy parents, professionals valuing premium experiences.

- Convenience: Home workouts fit schedules; no gym commute.

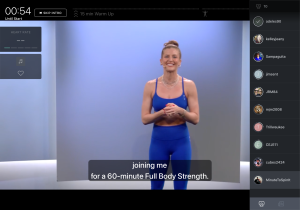

- Community: Leaderboards, live classes, tags foster belonging.

- Quality: Perceived best equipment, engaging instructors.

- Lifestyle: Health-conscious, tech-savvy, aspirational fitness.

Many replace boutique classes; retention >90% annually.

| Demographic | Percentage/Details |

|---|---|

| Women | 67% |

| Age 35-44 | 33% (largest) |

| Household >$100k | 60%+ |

| U.S.-based | 88% revenue |

Data from 2024 investor insights and surveys.

Why They Choose Peloton

Premium pricing attracts committed users.

- Immersive classes motivate consistency.

- Multi-modal (cycling, strength, yoga) appeals broadly.

- Social features reduce isolation.

- Long-term value over gym memberships.

“Community and instructors drive loyalty.” – User trends.

Explore stats at Business of Apps Peloton report.

FAQ

Who is Peloton’s main audience?

Women aged 35-54 with high incomes seeking home fitness convenience.

Are most Peloton buyers young?

No; core 35-54, minimal under 25.

Why do affluent people buy Peloton?

Premium quality, community, time-saving workouts justify cost.

Is Peloton only for women?

No, but 67% female; appeals broadly.

Has the buyer demographic changed?

Broadened slightly post-pandemic, but core remains affluent adults.

Final Thoughts

Peloton buyers prioritize convenience, community, and premium experiences—predominantly women in their 30s-50s with disposable income. This focused demographic drives high engagement and retention in a competitive market. As home fitness evolves, understanding these motivated users ensures Peloton’s continued relevance for immersive, motivating workouts.